Difference between revisions of "'''Public finance and budget public finance receipts- Activity 1.'''"

Jump to navigation

Jump to search

Gurumurthy (talk | contribs) (Created page with "{{subst:SS-Activity}}") |

Gurumurthy (talk | contribs) |

||

| Line 1: | Line 1: | ||

__FORCETOC__ | __FORCETOC__ | ||

| − | =Activity - | + | =Activity - Identifying the receipts in a typical budget of Government of India= |

==Estimated Time== | ==Estimated Time== | ||

| + | one period | ||

| + | |||

==Materials/ Resources needed== | ==Materials/ Resources needed== | ||

| + | News paper articles, videos on budget of Government of India | ||

| + | #[http://archive.financialexpress.com/news/union-budget-2014-for-every-indian-rupee-in-govt-kitty-24-paise-to-come-from-borrowing/1268608 2014-15 Budget sources] | ||

| + | #[http://pib.nic.in/archieve/others/2013/feb/d2013022801.pdf 2013-14 Budget sources] | ||

| + | |||

==Prerequisites/Instructions, if any== | ==Prerequisites/Instructions, if any== | ||

| + | |||

==Multimedia resources== | ==Multimedia resources== | ||

| + | [[File:budget 2013-14 India.png|400px]] | ||

| + | |||

==Relevant local connections - people, places and materials== | ==Relevant local connections - people, places and materials== | ||

| + | |||

==Website interactives/ links== | ==Website interactives/ links== | ||

| + | Collect the data of budget of Government of India for a few years. Take the information on receipts and the breakup given by components - tax revenues (and within this direct taxes and indirect taxes), non tax revenues, borrowings and deficit funding | ||

| + | |||

==Process== | ==Process== | ||

| + | Explore the different components of receipts. Take the percentage analyses provided and discuss the reasons for the share of different components in India. You can also contrast this with the budget of a developed country like USA or Denmark and see the differences in the receipts. | ||

| + | |||

==What questions can you ask== | ==What questions can you ask== | ||

| + | #If the share of receipts by way of taxes increase and that by borrowings reduce, what would be the possible results? | ||

| + | #Why does the Government not increase deficit financing to meet all expenditure needs? | ||

| + | |||

==Evaluation – (questions for assessment of the child)== | ==Evaluation – (questions for assessment of the child)== | ||

| + | |||

==Question Corner== | ==Question Corner== | ||

| + | |||

==Activity keywords== | ==Activity keywords== | ||

| − | + | '''To link back to the concept page''' [[Public_Finance_And_Budget]] | |

| − | '''To link back to the concept page''' | ||

| − | [[ | ||

Revision as of 11:32, 9 November 2014

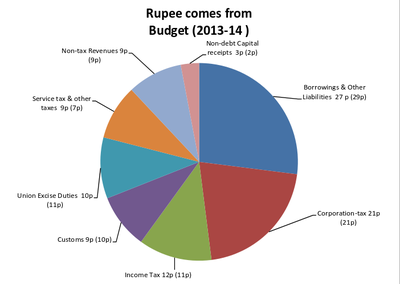

Activity - Identifying the receipts in a typical budget of Government of India

Estimated Time

one period

Materials/ Resources needed

News paper articles, videos on budget of Government of India

Prerequisites/Instructions, if any

Multimedia resources

Relevant local connections - people, places and materials

Website interactives/ links

Collect the data of budget of Government of India for a few years. Take the information on receipts and the breakup given by components - tax revenues (and within this direct taxes and indirect taxes), non tax revenues, borrowings and deficit funding

Process

Explore the different components of receipts. Take the percentage analyses provided and discuss the reasons for the share of different components in India. You can also contrast this with the budget of a developed country like USA or Denmark and see the differences in the receipts.

What questions can you ask

- If the share of receipts by way of taxes increase and that by borrowings reduce, what would be the possible results?

- Why does the Government not increase deficit financing to meet all expenditure needs?

Evaluation – (questions for assessment of the child)

Question Corner

Activity keywords

To link back to the concept page Public_Finance_And_Budget